Federal Employer Identification Number (EIN)

EIN Application ServiceWe will file your EIN application and obtain your EIN or use the links provided and do it yourself (it’s easy and FREE!)

There are a few ways to get your EIN.

Do it yourself for free.

-

- Download the filable DF and mail to the IRS.

- Use thee free IRS EIN Online Website

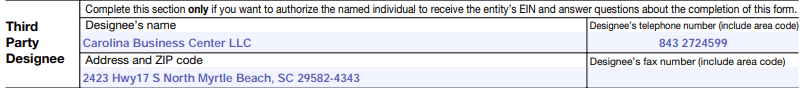

Hire us to do it for you for $25.00

Do It Yourself For Free

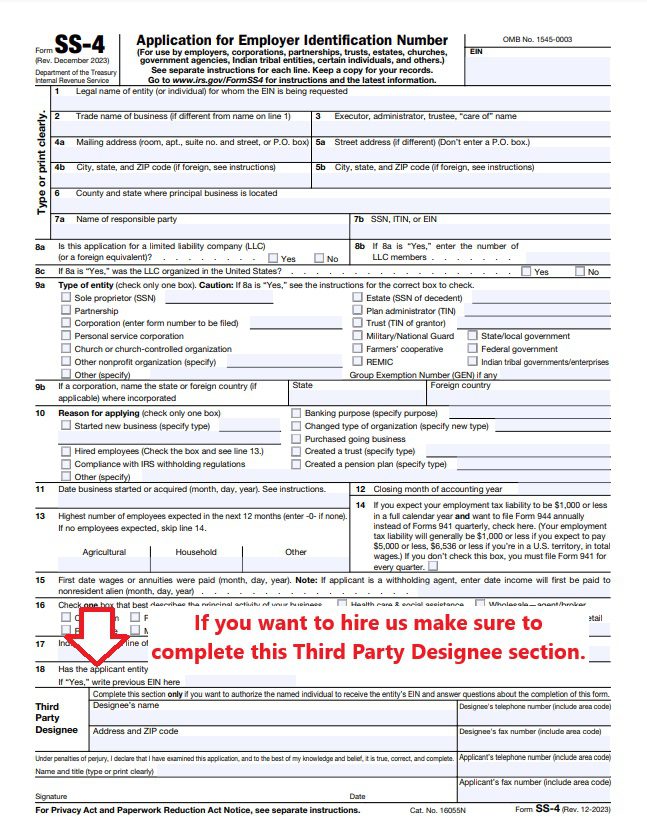

Application for Employer Identification Number

- Download this filable IRS PDF and mail to the IRS.

- You can also do yourself for free using the IRS EIN Online Website.

Hire Us $25 Fee

Hire us to file your EIN application and obtain your EIN for $25.00 one-time charge.

Download and complete this filable IRS SS-4 form and email to us at service@carolinabusinescenter.com

Purpose of an employer identification number

Employer Identification Numbers are issued for the purpose of tax administration and are not intended for participation in any other activities (e.g., tax lien auction or sales, lotteries, etc.)

You will need an EIN if any of the following are true:

- You have employees

- You operate your business as a corporation or a partnership

- You file any of these tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms

- You withhold taxes on income, other than wages, paid to a non-resident alien

- You have a Keogh plan

- You are involved with any of the following types of organizations

- Trusts, except certain grantor-owned revocable trusts, IRAs, Exempt Organization Business Income Tax Returns

- Estates

- Real estate mortgage investment conduits

- Non-profit organizations

- Farmers’ cooperatives

- Plan administrators

Exempt organization information

If you believe your organization qualifies for tax exempt status (whether or not you have a requirement to apply for a formal ruling), be sure your organization is formed legally before you apply for an EIN. Nearly all organizations exempt under IRC 501(a) are subject to automatic revocation of their tax-exempt status if they fail to file a required annual information return or notice for three consecutive years. When you apply for an EIN, we presume you’re legally formed and the clock starts running on this three-year period.

Example: Your organization applies for an EIN in November 2023 and chooses a December accounting period. Your first tax period would end on December 31, 2023, and your first return or notice (if your organization does not meet one of the few exceptions to the annual reporting requirement) would be due May 15, 2024. You would be subject to automatic revocation of your exemption if you fail to file for the three periods that end December 31, 2025 (return/notice due May 15, 2026) or for any consecutive three-year period thereafter.

Reporting of beneficial ownership information

You may be required to report certain information on your beneficial owners to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the United States must report information about their beneficial owners—the persons who ultimately own or control the company, to FinCEN beginning on January 1, 2024. If you are a company required to report, the initial beneficial ownership information reporting is based on the date your company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

Questions such as will my company be required to report beneficial ownership information to FinCEN, who is a beneficial owner, and when do I need to report my company’s beneficial ownership information are found on FinCEN’s website.

Frequently Asked Questions – FAQ

Does the IRS accept symbols as part of a business name?

No. The only characters IRS systems can accept in a business name are: 1) alpha (A-Z), 2) numeric (0-9), 3) hyphen (-), and 4) ampersand (&). If the legal name of your business includes anything other than those listed above, you will need to decide how best to enter your business name into the online EIN application. Following are some suggestions:nt.

What to do if your entire address won't fit on your address line on the Internet application?

IRS systems only allow 35 characters on the street address line. If your address does not fit in 35 characters, please make sure you provide the most essential address information (i.e., apartment numbers, suite numbers, etc). We’ll then validate the address you’ve provided with the United States Postal Service’s database and offer you an opportunity to make any changes to the address, if necessary.

When can I use my Internet EIN to make tax payments or file returns?

This EIN is your permanent number and can be used immediately for most of your business needs, including:

- Opening a bank account

- Applying for business licenses

- Filing a tax return by mail

However, it will take up to two weeks before your EIN becomes part of the IRS’s permanent records. You must wait until this occurs before you can:

- File an electronic return

- Make an electronic payment

- Pass an IRS Taxpayer Identification Number (TIN) matching program

Are any entity types excluded from applying for an EIN over the internet?

No. All customers whose principal business, office or agency, or legal residence (in the case of an individual) is located in the United States or in one of the U.S. Territories can apply for an EIN online. The principal officer, general partner, grantor, owner, trustor etc. must have a valid Taxpayer Identification Number (Social Security Number, Employer Identification Number, or Individual Taxpayer Identification Number) in order to use the online application. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.

If you were incorporated outside of the United States or the U.S. territories, you cannot apply for an EIN online. Please call us at 267-941-1099 (this is not a toll-free number) between the hours of 6 a.m. to 11 p.m. Eastern Time.

What if I forget the number I obtained over the internet?

IRS records will be updated immediately with your EIN. Simply call (800) 829-4933 and select EIN from the list of options. Once connected with an IRS employee, tell the assistor you received an EIN from the Internet but can’t remember it. The IRS employee will ask the necessary disclosure and security questions prior to providing the number.

Why should I complete the application online when I can send in paper or fax with missing information?

Generally, you will receive your EIN immediately when applying online. When paper or faxed Forms SS-4 are submitted with missing information it will delay the issuance of your Employer Identification Number.

Do all the EIN's obtained on the internet start with specific numbers?

Yes. The unique prefixes (20, 26, 27, 45, 46, 47, 81, 82, 83, 84, 85, 86, 87, 88, 92, 93, 99) identify the EIN as a number issued via the internet.

Now that I have my EIN, when can I use it to make tax deposits?

Based on the information you submit on your application or if you indicate you will have employees, you will automatically be enrolled in the Electronic Federal Tax Payment System—EFTPS—so you can make all your deposits online or by phone. Within a few days you will receive by mail your EFTPS enrollment confirmation, as well as a Personal Identification Number (PIN) and complete instructions for using EFTPS. You will need to wait until you receive your EFTPS information in the mail before you can make a payment electronically. Once you receive your EFTPS confirmation package, you can begin making EFTPS payments.

EFTPS is a service provided free by the U.S. Department of the Treasury that allows individual and business taxpayers to initiate all Federal tax payments using the internet or phone. You can input your tax payments 24 hours a day, 7 days a week using a secure government website or an automated voice response phone system. Refer to Publication 4275, EFTPS Express Enrollment for New Businesses PDF for additional information about EFTPS.